This Just In: The 2023 Black Friday Weekend Recap

Dubbed by our team the “Holy Retail Trinity,” the Black Friday, Small Business Saturday, Cyber Monday combo weekend comes around each year with predictions from every corner of the media.

We’re here to tell you what actually happened. Not from the lens of wise economists or analysts (no shade), but from the shoppers themselves.

Powered by Field Agent shoppers across the country, we surveyed 1,250 Americans about how they chose to spend their time and dollars this Black Friday Weekend. We’ll be specifically talking about:

- Time spent in-store versus online

- Impulse buying

- Popular purchase categories and out of stocks

- The shopper’s overall perspective

You can find more about the demographics of our random survey participants at the end of the article.

Time Spent In-Store vs Online

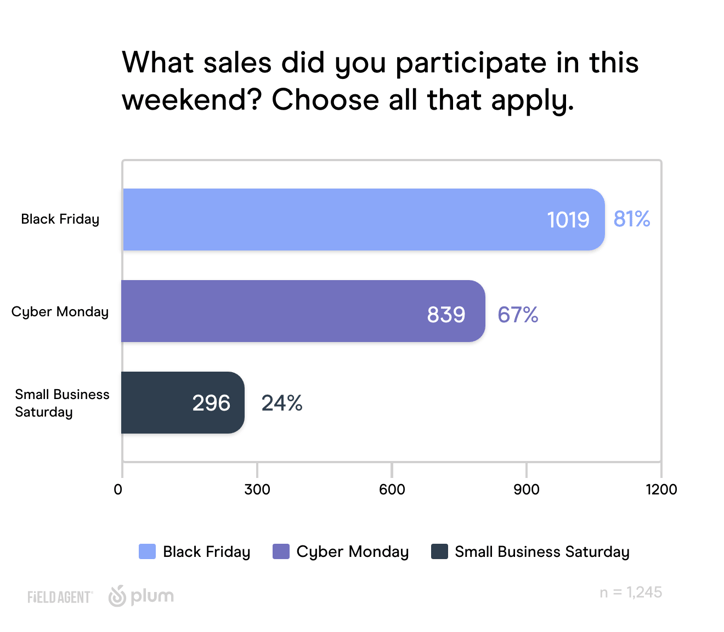

In our hyper-online-connected era, it’s wild to think that people would choose to shop in person versus online nowadays. But, the data doesn’t lie. 80 percent of the survey respondents said they shopped on Black Friday, with Cyber Monday bringing up the rear at 67%. We get it though: purchasing jeans online takes some serious trust.

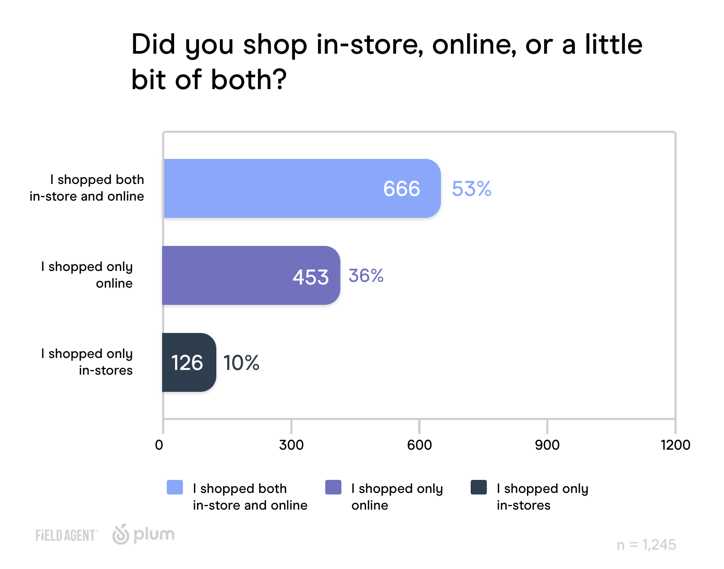

However, in the next question we see that those crowd fighting Black Friday shoppers also chose to shop online. (Aka: they didn’t spend their money only in brick and mortar stores.) Only about 1 in 10 people visited stores only throughout the weekend sales.

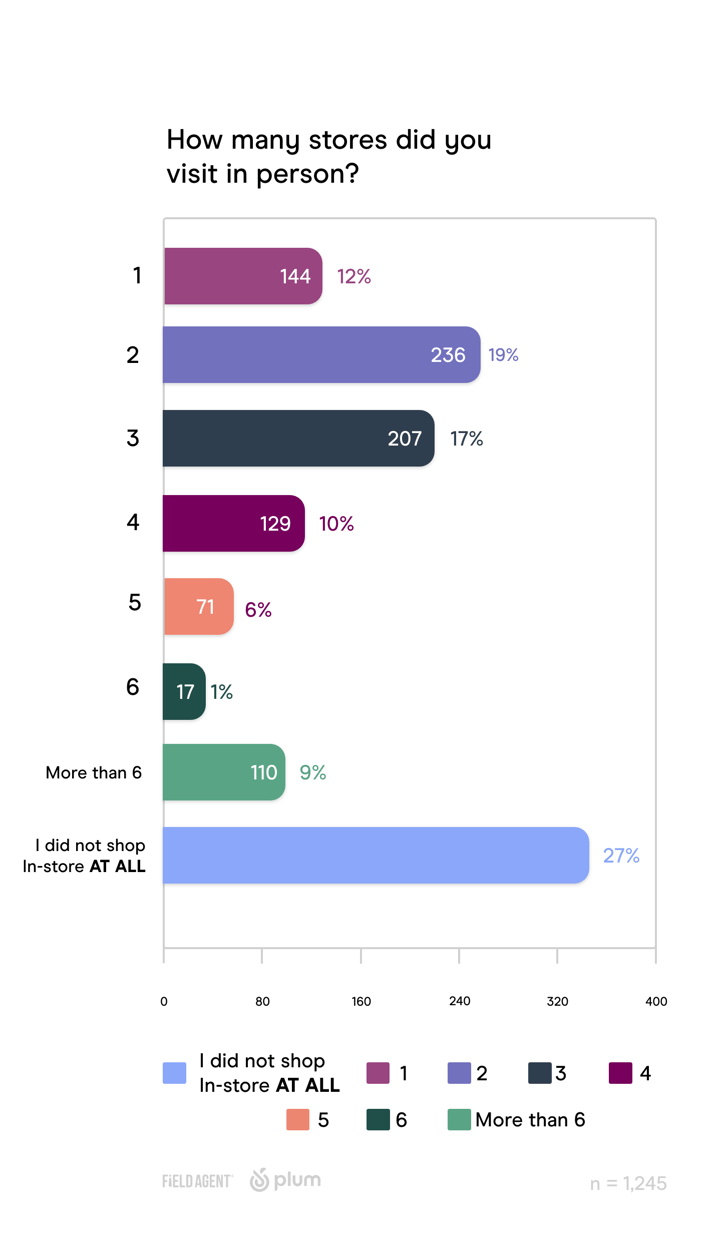

Of those who did shop in stores — we asked how many stores they visited. The 2023 in-store shopper during Black Friday visited an average of 2-3 stores. Few visited more than 5 or 6.

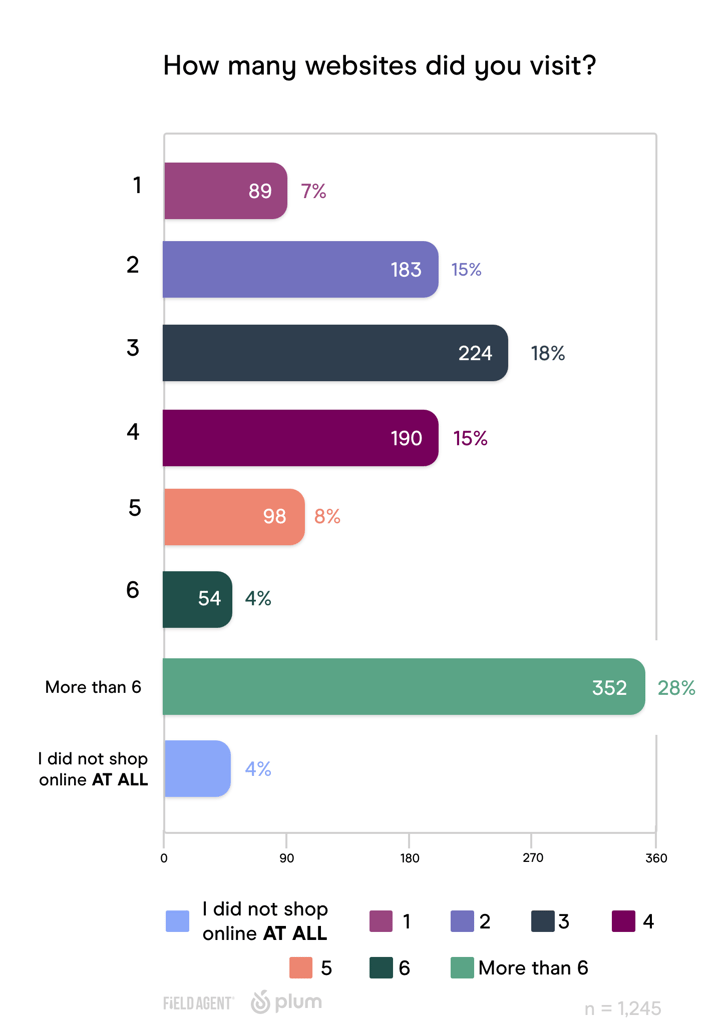

Of those who did shop in stores — we asked how many stores they visited. The 2023 in-store shopper during Black Friday visited an average of 2-3 stores. Few visited more than 5 or 6. Websites, on the other hand? We see the majority of shoppers actually visited more than six websites to browse options and compare prices.

Websites, on the other hand? We see the majority of shoppers actually visited more than six websites to browse options and compare prices.

2023 Black Friday Theme: Impulsivity

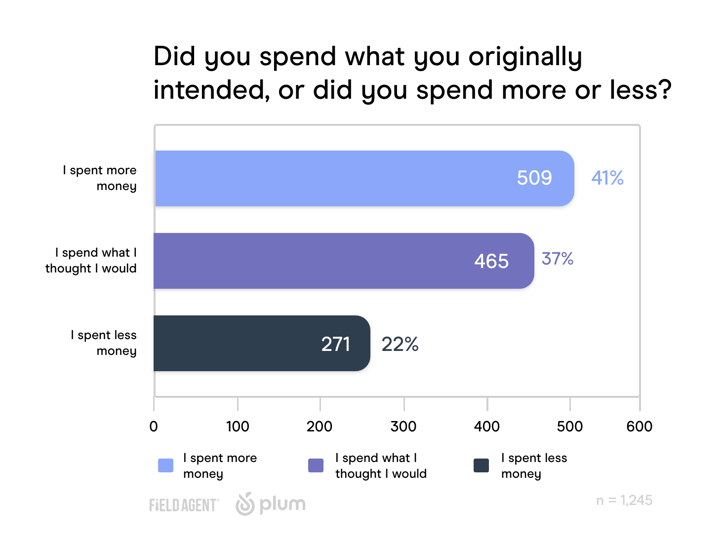

The buyer’s intent throughout this year’s Black Friday Weekend wasn’t too influenced by inflation. According to the shoppers, 78% said they spent what they thought they would, or maybe even more

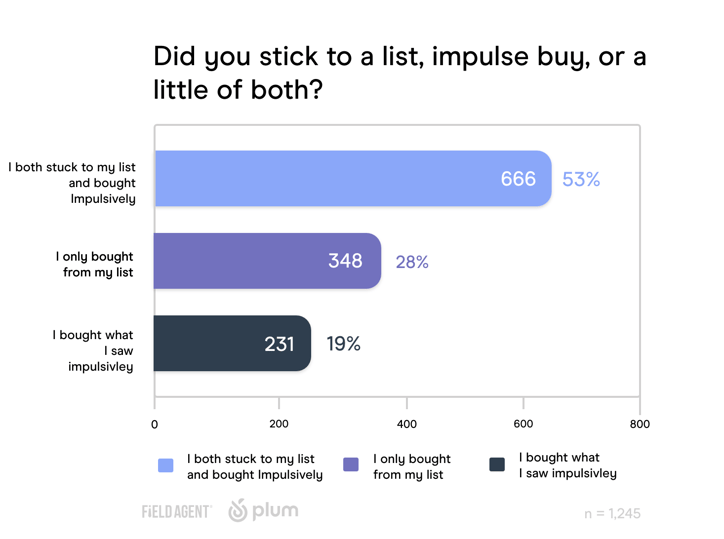

Even though some shoppers stayed within their individual budget, the majority of them bought some items impulsively. Although it may seem impulsive to the shopper, we know that cognitive, social, and emotional factors that influence purchasing decisions — brands and retailers can strategically position their products and connect with shoppers on a deeper level.

Even though some shoppers stayed within their individual budget, the majority of them bought some items impulsively. Although it may seem impulsive to the shopper, we know that cognitive, social, and emotional factors that influence purchasing decisions — brands and retailers can strategically position their products and connect with shoppers on a deeper level.

With only 28% of shoppers saying they completely stuck to their list, there’s obviously wiggle room for influence. Brands recognize that 72% gap to strategically promote, place, and price their items in that area for shoppers to “naturally encounter”.

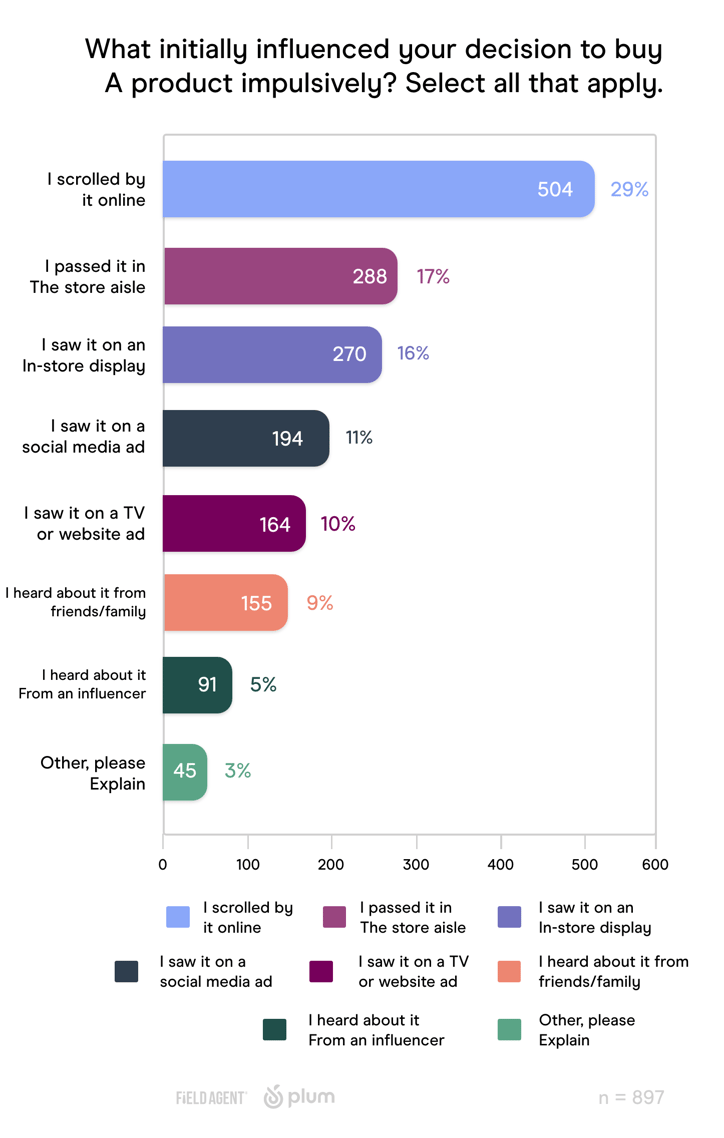

It’s evident that the shoppers that impulsively bought a product this year bought it “by chance,” perusing past it while sitting on their couch or passing by it in their local store.

The real stats to notice are the influences of in-store displays, social media, TV, and web advertisement — most things that brands control. This even trumps the influence of friends and family members.

Categories of Purchase + Demand

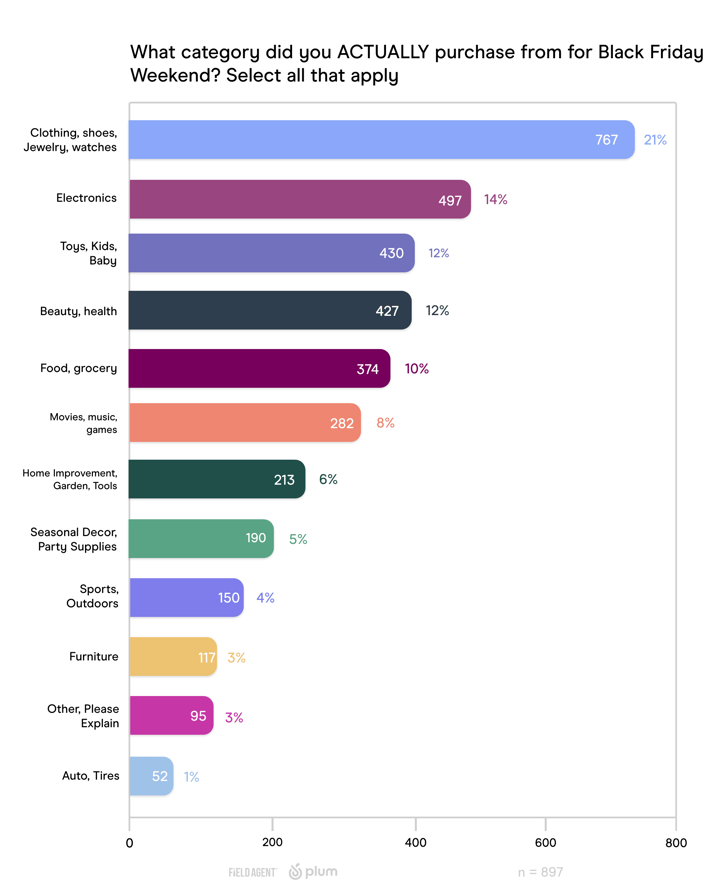

Clothes and electronics typically take the cake during the Black Friday Weekend, and this year was no different.

In the “other” category, shoppers submitted responses outside of the main options. Some responses were:

- Craft and art supplies

- Gym equipment

- Pet supplies

- Books

We were nosy, though. We asked shoppers to tell the whole story. Did they encounter a large amount of out of stocks while shopping over the 2023 Black Friday Weekend? And if so, what did they do about it?

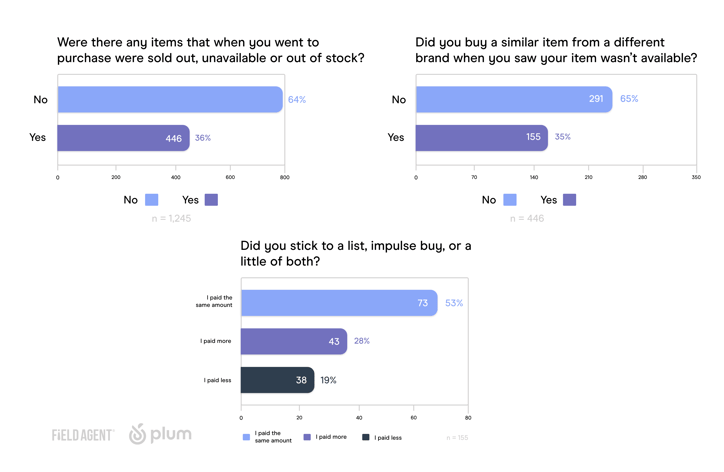

Survey says that more than ⅓ of all shoppers encountered items that were sold out, unavailable, and out of stock. Of those 36%, ⅓ of those shoppers said they purchased a similar item from a different brand when they saw it was out of stock — many even paying more.

If you’ve been reading along and have skimmed up to this point, now’s the time to listen up. (Or, “read close”, we guess.) Running an on-shelf availability audit for stores saves you profit in the long run. Monitor on-shelf availability to avoid costly out of stocks and losing your customer to your competitors.

The Shopper’s Perspective

They say perception is reality — right? Shoppers took to the internet (ahem, social media) to share their thoughts about the 2023 Black Friday Weekend in comparison to years past. Positively speaking, shoppers said they liked how deals were spread out over the whole month and there were less people in stores. Negatively speaking, shoppers said they didn’t like how everything seemed more expensive and they felt manipulated into thinking they were getting a deal when it really wasn’t.

As the whirlwind of the "Holy Retail Trinity" weekend is in our rearview, let's not simply file away these insights but harness them for a successful year-end. At Plum, we understand the dynamic landscape of consumer behavior, and we invite you to make the most of our solutions to navigate the remaining weeks of the year as painless as possible.

Explore our offerings and turn the remainder of the year into an opportunity to exceed your financial goals. Start a project solo today, or talk with an expert on our team to see how you can make the most of the season.

All survey respondents were U.S. adults at least 18 years of age and smartphone owners. The survey was executed through the Field Agent platform, November 28, 2023, with a non-random sample of shoppers. Demos: Gender - Female (71%), Male (27%), Prefer Not to Say (2%) Age - 18-20 (1%), 21-29 (15%), 30-39 (37%), 40-49 (28%), 50-59 (15%), 60+ (4%); Household Income - < $35K (12%), $35-49K (12%), $50-74K (15%), $75-99K (12%), $100K+ (23%), Prefer Not to Say (9%); Race/Ethnicity - Caucasian/White (61%), Asian American (7%), Latino/Hispanic (7%), African American/Black (6%), Native American (1%), Other (3%).